Simple Info About How To Find Out If You Are Entitled To A Tax Rebate

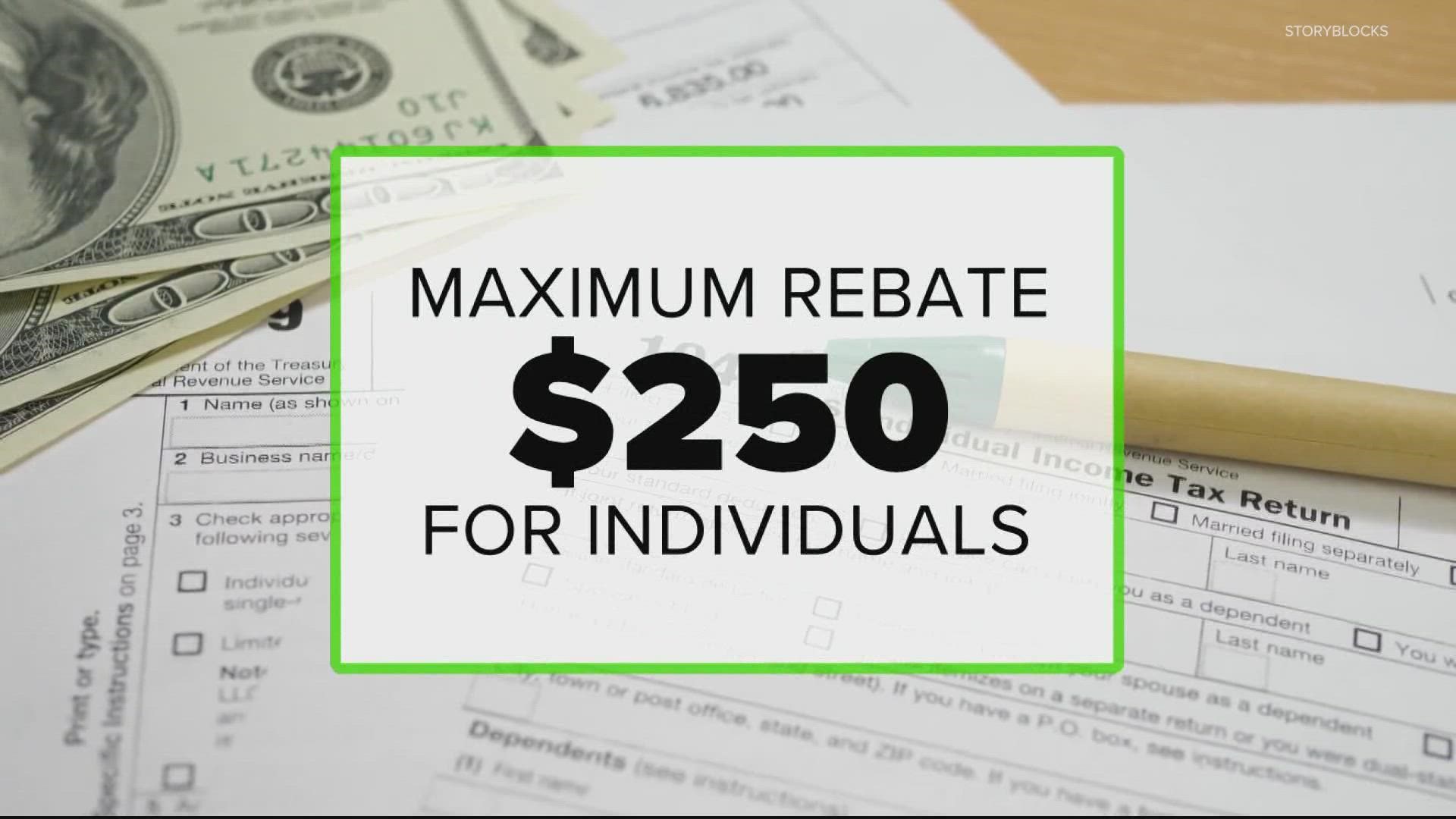

The maximum standard rebate is $650, but supplemental rebates for qualifying homeowners can boost rebates to $975.

How to find out if you are entitled to a tax rebate. The net amount of loss reported on. Virginia expects to issue 2.9 million cash rebates before oct. You may be able to get a tax refund (rebate) if you’ve paid too much tax.

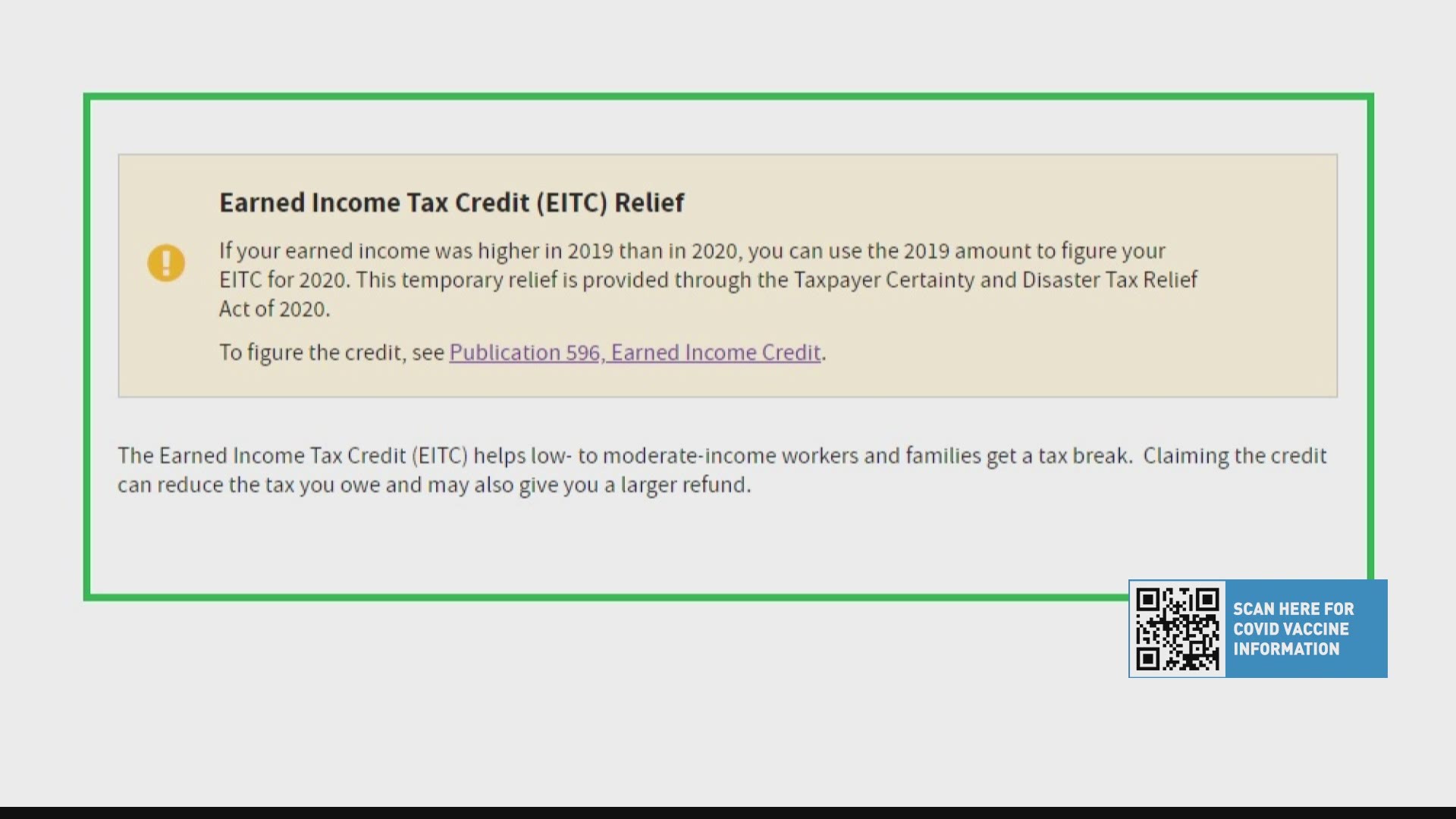

At quickrebates it is common to find the real tax. You must file a return to claim the credit, even if you don't usually file a tax return. There are many circumstances where you could be due a tax rebate.

You wash your own uniform for work; Though income tax preparation isn’t easy. Some 6 million illinois residents are receiving an income tax rebate, property tax rebate or both, thanks to the state's $1.8 billion family relief plan.physical checks started.

For the homeowner tax rebate credit, income is defined as federal adjusted gross income (fagi) from two years prior (tax year 2020), modified so that: You are eligible for the initial $125 automatic taxpayer refund if you filed an indiana resident tax return for the 2020 tax year with a postmark date of jan. Our tax return calculator is quite dynamic and will give you an estimate of what you could be entitled to.

The credit is based on your 2021 tax year information, so any third economic impact payments. If you have started a new business; Use this service to see how to claim if you paid too much on:

The property tax/rent rebate program is one of five programs. How do i know if i am owed a tax rebate or refund? Use this lookup to determine the amount you'll receive for the homeowner tax rebate credit (htrc).

/do0bihdskp9dy.cloudfront.net/09-13-2022/t_69745b8fb2da4f65916b4044cbd266a1_name_file_1280x720_2000_v3_1_.jpg)