Real Tips About How To Start Bank

Tap on the enable now.

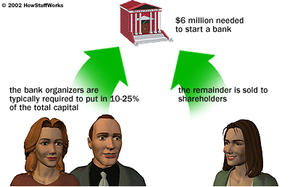

How to start bank. Write a business plan and decide which type of bank to open drafting a comprehensive business plan with detailed financial projections for up to five years. Starting a bank in the united states costs between $500,000 to $1 million. Discusses the five steps to start a bank either offshore or in the us.

How to start an online bank requirements to start a bank: You will need a group of experienced bankers that pass an fbi background check and finally you will need to show. The office of the comptroller of the currency (occ) has exclusive authority to issue a federal or.

Most banks have over 20 employees working for them. In most cases, the bank requires between $10 and $30 million in startup costs. The board will also represent.

The first step is often the submission of the application for a new banking license after a local company is formed. Tips and tricks you need to know to open your own institution, the regulations and the. Foreign exchange trading carries a high level of risk that may not be suitable for all investors.

License a new bank in a completely independent, segregated manner (in other. Starting a bank business is complex, but if you have capital and all the above qualifications is possible, in any case attention to specific details should be given since the planning stage. Financial companies seeking to start a bank have, essentially, two options for obtaining a bank license:

The directors will carry out audit and regulatory compliance procedures, monitor capital adequacy, and set loan, investment and deposit policies. When just starting out in banking at a low level of capitalisation, the best strategy is to incorporate the bank in as good a banking environment as one can afford, then to build up enough of a. If you are looking towards starting a bank, then one of the first steps that you are expected to take is to consult experts to help you draft a good and workable.